Introduction

The panorama of finance is evolving extra than ever before, underpinned with the aid of technological upgrades that redefine conventional practices.

The financial industry is currently undergoing a massive transformation, with the younger generation at the forefront of this change. The Nasdaq FintechZoom prediction highlights how Nasdaq is emerging as a major player, guiding the financial institution into the future with its cutting-edge initiatives.

This in-depth piece delves at how Nasdaq has shaped modern finance and speculates on what the future holds for the nexus of technology and finance.

NASDAQ plays a pivotal role in shaping the future of fintech through strategic listings and investment opportunities. FintechZoom.tech serves as a vital resource for insights into these trends, providing a comprehensive view of market dynamics and future predictions.

Understanding these developments is essential for stakeholders aiming to navigate this evolving sector.

Nasdaq, famed for its robust buying and selling platform, is steerage those adjustments, blending finance with cutting-edge era to herald a nowadays’s technology of monetary offerings.

Key Features

- NASDAQ’s influence on fintech innovations is substantial, facilitating growth and investment.

- Predictions for upcoming trends in finance highlight significant shifts toward digital solutions and data-driven insights.

- Analysis of market shifts indicates a rising demand for sustainable finance and advanced technology

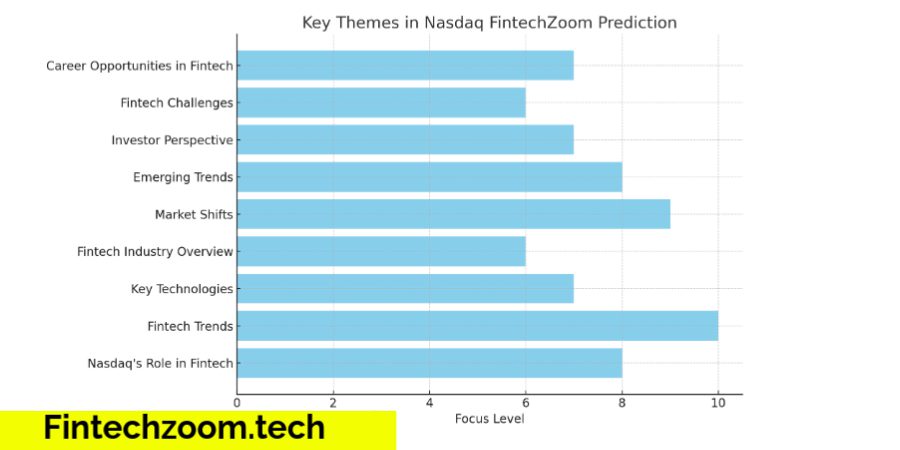

Live graph of nasdaq fintechzoom prediction

Fintezoom’s inception

The Nasdaq FintechZoom prediction represents a significant milestone in the convergence of finance and technology. It embodies a digital transformation, seeking to break down the barriers that have historically made financial markets exclusive and difficult to access.

Through using superior algorithms, blockchain era, and artificial intelligence, Nasdaq FintechZoom prediction opens up the monetary markets to a broader target audience, ensuring that people and establishments alike can take part within the financial surroundings on a more equitable footing.

The initiative makes a speciality of key areas, including streamlining the shopping for and promoting device, enhancing cybersecurity measures to protect consumer information and belongings, and supplying instructional belongings to demystify the making an funding manner.

By doing so, Nasdaq isn’t continually simply democratizing get proper of entry to to economic markets but is likewise empowering customers with the equipment and statistics essential to make knowledgeable selections.

COMPASSION FOR FINTECHZOOM

FintechZoom represents the harmonious aggregate of financial services with era, geared inside the direction of revolutionizing the manner economic transactions are carried out. It’s about improving accessibility, tempo, and efficiency in monetary services, making them extra adaptable to trendy day digital worldwide.

The Current Landscape of Fintech

The fintech industry today represents a confluence of technology and financial services, characterized by rapid growth and innovation.

- Key players include established banks adopting digital solutions and startups disrupting traditional models.

- Innovations such as mobile applications and peer-to-peer lending platforms are redefining user experiences.

- According to recent reports, global fintech investments reached $210 billion in 2021, illustrating the sector’s explosive growth.

THE RISE OF NASDAQ

Nasdaq fintechzoom prediction trajectory from a worldwide economic change to a modern leader showcases its willpower to revolutionizing the finance region. Historically, it made its mark with the useful resource of introducing virtual shopping for and promoting, setting the diploma for the present day, technology-pushed monetary market we see these days.

It’s Influence on Fintechzoom

NASDAQ has emerged as a critical driver of fintech development.

- Its role in listing fintech companies provides them with visibility and access to capital.

- NASDAQ also supports regulatory frameworks that foster innovation while ensuring market integrity.

- This synergy enhances investor confidence and attracts further investments in the fintech ecosystem.

Key trends of Nasdaq fintechzoom prediction:

Current tendencies in Nasdaq FintechZoom prediction , consisting of decentralized finance and mobile price answers, illustrate the dynamic nature of the arena. Nasdaq’s strategic response to those trends demonstrates its role as a catalyst for economic innovation.

Emerging Technologies in Finance

Several technologies are significantly shaping the future of finance.

- AI and machine learning applications are revolutionizing data analytics, enabling personalized financial services.

- Blockchain technology facilitates secure transactions and enhances transparency in financial operations.

- Emerging trends in cryptocurrency also indicate a growing acceptance among traditional financial institutions.

Fintech Revolution

The Fintech revolution symbolizes the shift toward computerized, tech-savvy economic offerings. From blockchain and AI to big records analytics, generation disrupts traditional finance, paving the manner for greater customized and inexperienced monetary solutions.

NASDAQ Fintechzoom Prediction

Expert forecasts suggest an optimistic trajectory:

- Anticipated market changes include increased collaboration between traditional banks and fintech firms.

- Economic factors, such as interest rates and inflation, are expected to influence investment strategies within the sector.

The Rise of Digital Banking

Digital banking solutions have gained substantial traction.

- A comparison with traditional banking reveals a shift in consumer preferences towards convenience and efficiency.

- User adoption rates are soaring, with over 70% of consumers using online banking platforms as of 2022.

Regulatory Changes Impacting Fintech

Current regulations are shaping the fintech landscape.

- Regulatory frameworks are designed to foster innovation while protecting consumers and maintaining market integrity.

- Future regulatory predictions indicate a continued focus on consumer protection and data privacy.

As regulations evolve, fintech firms must adapt to maintain compliance while driving innovation.

The Role of Data Analytics

Data analytics has become a cornerstone of fintech decision-making due to nasdaq fintechzoom prediction.

- Its importance lies in the ability to derive actionable insights that guide investment strategies and product development.

- Tools and platforms for data analysis are increasingly being adopted by fintech companies to enhance operational efficiency.

The Shift to Mobile Payments

The adoption of mobile payments is on the rise, reflecting changing consumer behaviors.

- Trends indicate a growing preference for mobile transactions, particularly among younger demographics.

- Security concerns remain paramount, leading to advancements in encryption and fraud detection technologies.

Sustainability in Finance

Sustainability has emerged as a significant focus in the finance sector.

- An increasing emphasis on ESG (Environmental, Social, Governance) factors is reshaping investment strategies.

- Fintech innovations are addressing sustainability challenges, with predictions for green finance initiatives gaining traction.

The Impact of Global Events on Fintech

Recent global events have had profound effects on the fintech landscape.

- The COVID-19 pandemic accelerated digital transformation, pushing consumers and businesses to adopt digital solutions.

- Geopolitical factors, such as trade tensions and regulatory changes, are influencing market dynamics.

Future Career Opportunities

The job market in fintech is expanding, presenting numerous career opportunities.

- Key skills in demand include data analysis, cybersecurity, and financial modeling.

- Educational resources are increasingly available, equipping aspiring professionals with the necessary knowledge to succeed.

Investment Strategies

Approaches to investing in fintech companies are evolving.

- Investors are advised to conduct thorough risk assessments and diversify portfolios to mitigate potential losses.

- Future trends indicate a growing interest in companies focusing on sustainable finance and advanced technologies.

Collaboration Between Fintech and Traditional Finance

Collaborative efforts between fintech firms and traditional financial institutions are on the rise.

- These partnerships yield mutual benefits, including enhanced service offerings and improved customer experiences.

- Successful case studies illustrate the potential for innovation through collaboration.

The Role of FintechZoom.tech in the Ecosystem

FintechZoom.tech plays an essential role in providing insights and resources.

- The platform offers valuable tools for investors and stakeholders, facilitating informed decision-making.

- Community engagement initiatives promote knowledge sharing and collaboration within the fintech ecosystem.

Securing The Future With Nasdaq FintechZoom

The feature of cybersecurity inside Nasdaq FintechZoom prediction becomes an increasing number of paramount because the virtual finance panorama evolves. Nasdaq’s determination to safeguarding economic transactions through advanced protection functions is a testament to the seriousness with which it procedures functionality cyber threats.

Implementing modern-day encryption and multi-problem authentication strategies, Nasdaq ensures that every transaction carried out inside the FintechZoom surroundings is stable from unauthorized get admission to.

In addition to securing transactions, there can be a strong consciousness on privateness and compliance with international information protection guidelines.

Nasdaq FintechZoom prediction integrates privacy-via-layout necessities, making sure that man or woman facts isn’t first-rate blanketed however also handled in a way that respects customers’ privateness and complies with rigorous worldwide necessities.

Emerging Technologies Reshaping Nasdaq FintechZoom prediction

The relentless tempo of innovation within the generation vicinity stays a the usage of pressure within the back of the evolution of Nasdaq FintechZoom. Artificial Intelligence (AI) and Machine Learning (ML) are at the leading edge, presenting extraordinary capabilities in automating complicated monetary procedures, improving customer service thru chatbots, and providing customized monetary recommendation.

Blockchain technology, identified for its crucial position in cryptocurrencies, is also making waves during traditional banking with the aid of allowing more regular, apparent, and efficient transactions.

Another extensive style is the upward push of the Internet of Things (IoT), which allows for the seamless integration of numerous monetary services into regular gadgets. This convergence of finance and era not excellent simplifies customer research however moreover opens up modern avenues for handling and making an funding coins.

Furthermore, the advent of 5G era guarantees to boost up those tendencies, presenting quicker, greater reliable connections that could help the sizable statistics dreams of the Nasdaq FintechZoom prediction panorama.

INVESTOR PERSPECTIVE

Investors are keenly looking the FintechZoom disruptions, recognizing the capability for excessive returns. Nasdaq’s appeal lies in its potential to find out and assist promising FintechZoom startups, providing beneficial possibilities for forward-wondering customers.

Conclusion

Key predictions and trends discussed herein illustrate the dynamic nature of the finance sector, particularly within fintech. Staying informed on these developments is paramount for stakeholders aiming to leverage opportunities in this evolving landscape. Insights from FintechZoom.tech provide valuable resources for navigating future predictions in the industry.

- The significance of NASDAQ’s predictions highlights the integration of technology within finance.

- The continuous evolution of the finance sector underscores the importance of adaptability and innovation.

- Resources available at FintechZoom.tech offer critical support for those engaged in the fintech ecosystem.

FAQs:

- What is Fintech?

Fintech, or financial technology, encompasses a broad range of services that integrate technology with financial operations to enhance efficiency, security, and user experience.

- How does NASDAQ support fintech companies?

NASDAQ supports fintech companies through strategic listings that provide visibility and access to capital while fostering an environment conducive to innovation.

- What trends should investors watch in fintech?

Investors should monitor trends such as the rise of digital banking, advancements in mobile payments, and the increasing focus on sustainable finance to inform their investment strategies.

- What are the key trends in fintech today?

Key trends in fintech include the rise of digital banking, advancements in mobile payments, increased adoption of blockchain technology, and a growing focus on sustainable finance and ESG (Environmental, Social, Governance) factors.

- What is the significance of blockchain technology in finance?

Blockchain technology enhances security, transparency, and efficiency in financial transactions. It enables decentralized systems that can reduce costs and fraud while improving transaction speed.

- How is data analytics used in fintech?

Data analytics in fintech is used to derive insights from large datasets, allowing companies to enhance decision-making, personalize services, and identify market trends. This helps improve customer experiences and operational efficiency.

- What are the main challenges facing fintech companies?

Fintech companies face challenges such as regulatory compliance, cybersecurity threats, competition from established banks, and the need to continuously innovate to meet consumer expectations.

- What role does artificial intelligence play in fintech?

Artificial intelligence (AI) is used in fintech for various applications, including fraud detection, credit scoring, customer service through chatbots, and personalized financial recommendations, enhancing overall efficiency and user experience.

- How can individuals invest in fintech companies?

Individuals can invest in fintech companies through stock purchases on exchanges like NASDAQ, investing in fintech-focused mutual funds or ETFs, or participating in crowdfunding platforms that support fintech startups.

- What is digital banking?

Digital banking refers to the digitization of traditional banking services, allowing customers to perform banking transactions online or via mobile applications, often with enhanced convenience and lower fees compared to traditional banks.

- How are regulatory changes affecting fintech?

Regulatory changes can significantly impact fintech by establishing compliance requirements that firms must meet. These regulations aim to protect consumers and ensure market stability while fostering innovation.

- What are the career opportunities in fintech?

The fintech sector offers diverse career opportunities, including roles in data analysis, software development, compliance, marketing, and product management. Skills in technology, finance, and regulatory knowledge are highly sought after.

- What are mobile payments, and how do they work?

Mobile payments enable consumers to make transactions using their smartphones through apps or digital wallets. They work by securely transferring funds through near-field communication (NFC), QR codes, or other methods.

- How does sustainable finance intersect with fintech?

Sustainable finance focuses on investments that consider environmental and social impacts. Fintech innovations are facilitating sustainable finance by providing tools for measuring and reporting ESG metrics, thus enabling responsible investment practices.

- What are cryptocurrency trends in the current market?

Current cryptocurrency trends include increasing institutional investment, the growth of decentralized finance (DeFi) platforms, and heightened regulatory scrutiny. Adoption of cryptocurrencies for payments is also on the rise among consumers.

- How does FintechZoom.tech contribute to the fintech ecosystem in nasdaq fintechzoom prediction?

FintechZoom.tech provides insights, resources, and tools for investors and stakeholders in the fintech sector. It fosters community engagement and promotes knowledge sharing, facilitating informed decision-making within the ecosystem.

If you want more info or want us to write for you, visit us