Unlocking inventory performance secrets and techniques is like navigating a maze of events, techniques, and metrics shaping a business enterprise’s financial direction. For investors and analysts, understanding excessive-boom stocks like Fintechzoom Upst Stock Holdings Inc.

Is greater than just ticker symbols — it’s approximately greedy its industry pulse and awaiting trade indicators. Fintechzoom Upst Stock, blending finance and tech, reimagines credit scoring the use of AI. In this weblog publish, we decode elements riding Upstart’s boom for investment insights. Join us to explore Fintechzoom Upst Stock journey and fintech phenomenon understanding.

Live Updates on Fintechzoom Upst Stock

Introduction

The fintech enterprise, a bustling arena of innovation, has birthed start-united statesthat revere boom as a mantra. Fintechzoom Upst Stock, born of this ethos, empowers its buyers with credit options that aspire to be more inclusive, facts-driven, and green.

However, for all its innovation and noble aspirations, the enterprise’s stock performance has been situation to the ebb and flow of marketplace dynamics, investor sentiment, and inner strategies.

In this section, we’re going to provide a quick creation to Upstart, outlining its function inside the fintech enterprise, and underscore why a granular understanding of its inventory overall performance is astoundingly pivotal for potential and existing buyers alike.

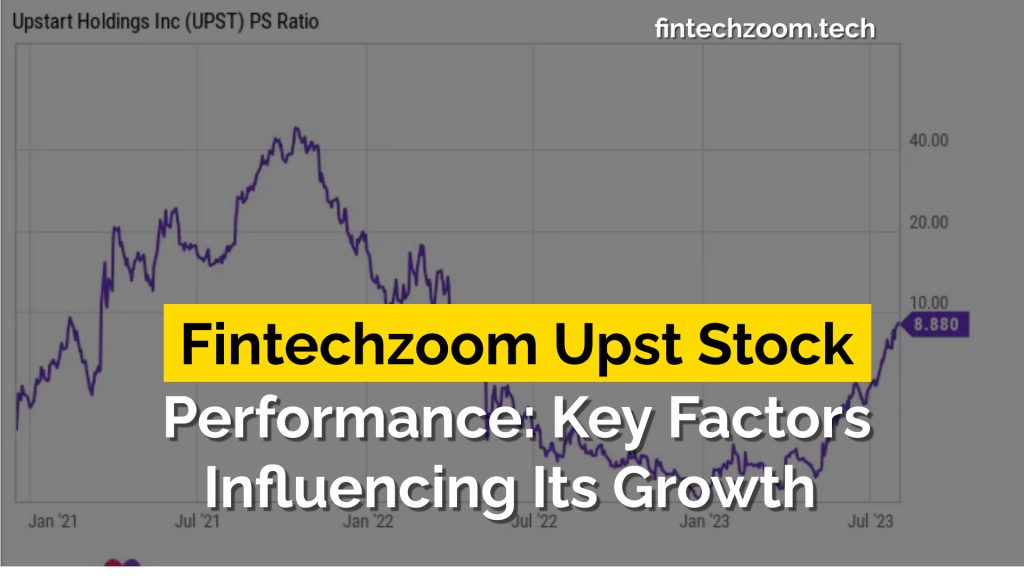

Historical Performance of Fintechzoom Upst Stock

Tracking Upstart’s ancient stock performance invokes a story teeming with growth and evolution. Established in 2012, the organization’s initial public providing (IPO) in 2020 became a trademark moment, fueling its ambition with an infusion of capital and investor agree with.

We’ll overview major milestones, which includes income reviews and big organisation activities, to glean insights into what catalyzed upward and downward developments in its inventory rate.

The retrospective evaluation will draw correlations among pivotal decisions, technological improvements, and the broader market forces that encouraged Upstart’s marketplace standing and fee.

Upstart’s Business Model

Upstart’s commercial enterprise model is a hybrid of traditional lending and cutting-edge generation. At its core, the organization disrupted the lending landscape by way of introducing a platform that makes use of system mastering to underwrite loans primarily based on non-traditional variables beyond credit score rankings.

The model now not only echoes extra fairness in credit evaluation however additionally promises to decorate predictability and decrease default risks.

This phase will dissect Upstart’s model, juxtaposing it towards enterprise giants and comparing its scalability and sustainability in the long run.

Also Read: 2024 Predictions For Fintechzoom Costco Stock

Technological Advancements

Technology isn’t always only a crutch for Fintechzoom Upst Stock; it forms the bedrock of its operations. Harnessing AI and device getting to know, the company has streamlined mortgage origination, efficaciously reducing turnaround times and operational charges.

We’ll discover the nuts and bolts of Upstart’s technological prowess and its impact on each client revel in and backside-line increase.

Additionally, we will behavior a comparative evaluation, pitting Upstart’s generation in opposition to conventional requirements to gauge its promise and capacity for in addition development.

Market Expansion Strategies

Global finance isn’t one homogenous market but an interplay of geographical idiosyncrasies. Upstart’s growth techniques are calibrated beyond large strokes, assuring cultural and local adaptability.

This segment will elucidate how Fintechzoom Upst Stock has deftly navigated the labyrinthine worldwide markets, unlocking doorways to growth even as fortifying its market percentage in already hooked up territories.

Furthermore, we’re going to prognosticate potential pathways for Fintechzoom Upst Stock future expansions, painting a canvas of marketplace opportunity towards a backdrop of global monetary dynamics.

Regulatory Environment

The fintech revolution has met resistance in the form of a nevertheless-evolving regulatory framework. Fintechzoom Upst Stock, in its relentless quest for progression, has to bounce to the tunes of regulators even as also influencing the prison discourse with its innovations.

This section will probe into the legislative hurdles that Upstart has surmounted and people that retain to pose challenges.

The conjecture here is important, as regulatory headwinds can capsize even the most promising of firms, and expertise Upstart’s navigation is pivotal for investor confidence.

Competitive Landscape

The fintech area is peopled with bold upstarts and incumbent titans, each vying for his or her slice of the pie. Fintechzoom Upst Stock, though a youthful contender, brings a formidable recreation plan and incredible agility.

This segment will provide an in depth competitive evaluation, dissecting Upstart’s relative benefits and countering its opposition’s strengths and weaknesses.

In addition, we will spotlight the agency’s strategic positioning, outlining its niche in the broader aggressive topography.

Partnerships and Collaborations

In the pursuit of unlocking boom, no business enterprise is an island, and Fintechzoom Upst Stock has fervently sought solace in partnerships and collaborations.

Whether it is with different fintech disruptors or traditional monetary institutions, Upstart’s collaborative ethos bears the hallmark of a wise method for increase. We’ll unravel the tapestry of key alliances that have buoyed Upstart’s ascent.

The exam of those partnerships will offer key takeaways for synergy-constructing in a company context and offer insights into future partnership techniques.

Financial Performance and Earnings Reports

The numbers don’t lie, and Upstart’s economic performance is a litmus take a look at of its company health. We’ll dissect the employer’s economic statements and income reports to unearth the metrics that signal boom, balance, and investor attraction.

Profit margins, revenue growth, and operational performance may be underneath the microscope, as we sift via the statistics to figure patterns and progressions.

Interpretation of this facts isn’t an esoteric exercise however the crux of informed investment decisions and industry narrative-shaping.

Also Read: 2024 Analysis On Fintechzoom Google Stock

Customer Acquisition and Retention Strategies

In a international where clients are both the lifeblood and the boom spur of a employer, knowledge how Fintechzoom Upst Stock acquires and retains its shoppers is paramount.

The business enterprise’s strategies, from traditional advertising and marketing to retention-focused tasks, might be unpacked to illustrate their affect on Upstart’s market share and consumer lifetime cost.

Reflections on Upstart’s purchaser technique will function a playbook for agencies across industries, presenting realistic insights for scalable and natural increase.

Management Team and Leadership

Leadership is the compass that guides a corporation thru the turbulent waters of growth. Upstart’s management group, with its collective enjoy, imaginative and prescient, and strategic acumen, warrants closer examination.

We’ll profile key management figures, scrutinizing their roles in steering Upstart’s ship, and draw parallels among their professional trajectories and the agency’s success.

The emphasis on leadership isn’t always unilateral but also bilateral, as we connect the dots among method and execution, foreseeing their implications on stock performance.

Investor Sentiment and Analyst Ratings

Stock performance, to a large volume, is governed much less via tough facts and more by using the collective subjectivity of investors. We’ll unpack Wall Street’s angle on Fintechzoom Upst Stock, scrutinizing analyst rankings, price goals, and investor sentiment indicators.

This phase will provide insights into the marketplace’s emotional undercurrents and their dating with Upstart’s cloth performance.

Gauging investor sentiment is comparable to peering into the fog to count on oncoming ships — it’s a strategic exercising in dealing with expectancies and capitalizing on marketplace psychology.

Risk Factors and Challenges

Predicting the destiny is a fraught exercise, mainly within the inventory marketplace. Risks lurk in the shadows, ready to pounce on the unwary and ill-prepared.

We’ll delineate the capability risks and demanding situations that Fintechzoom Upst Stock and the fintech enterprise face. From macroeconomic upheavals to technological hiccups, from legislative quagmires to inner turmoil, we’ll canvas an collection of eventualities and gauge their danger ranges.

This section will no longer merely indulge in a doomsday prophecy however offer a roadmap for hazard management — a prerequisite for sustained and robust investor returns.

Future Outlook and Growth Prospects

The denouement of our exploration leads us to conjecture the future of Fintechzoom Upst Stock and its growth potentialities. In the context of nascent fintech landscapes and a submit-pandemic world, we’re poised on the cusp of change.

This segment will synthesise marketplace developments, enterprise trends, and Upstart’s strategic path to provide a forecast that balances optimism with pragmatism.

Anticipating the future is an investor’s artwork, and our evaluation will provide the strokes needed to outline Upstart’s portrait inside the tapestry of fintech evolution.

Conclusion

The direction to expertise Upstart’s increase spree is fraught with complexity but imbued with possibility. By dissecting the tricky tapestry of technological finesse, collaborative spirit, market dynamics, and monetary basics, we have gleaned valuable takeaways for stock overall performance analysis and investment approach.

Upstart’s story isn’t always just one in every of a unmarried organization’s upward push however a microcosm of an enterprise in flux — one peppered with innovation, demanding situations, and burgeoning potential. If shares are, in a manner, a reflection of a organisation’s soul, Upstart’s trajectory resonates with echoes of change and a song of progress.

For an investor seeking to discern the styles in this dance of inventory overall performance, the tale of Fintechzoom Upst Stock is one replete with cues and clues. With a finger at the pulse of its increase drivers, the narrative of Upstart’s inventory performance will become an allegory for those seeking to comprehend, interact, and probably take advantage of the interplay of finance and era in the modern market.

Understanding Upstart’s complicated of increase drivers isn’t about soothsaying the inventory market but about forging a symbiotic relationship between analytical awareness and audacious imaginative and prescient.

It’s now not pretty much funding portfolios and stock tickers; it is about the zeitgeist of a rapidly-churning economic generation and the protagonists that outline it. In the pages that comply with, we’ll unfold the stratagems and testimonies that have underpinned Upstart’s price in this thrilling fintech narrative.

An inquisitive exploration into the forces shaping Upstart’s inventory performance is an investment in understanding itself — an asset greater invaluable than any stock certificate.

It is, within the final evaluation, a testament to our unending quest for understanding and significant engagement with the financial currents that weave the cloth of our collective monetary future.

With the fervor of an explorer and the discernment of a navigator, we flip our gaze to the complicated web this is Upstart’s stock performance, hoping to glean from it now not just financial returns, however a deeper revelation approximately the intertwining paths of finance and generation in the 21st century.

Margins and multiples are mere digits in this grander scheme; it’s the tale in the back of the numbers that definitely captivates the seeker in all of us.

Frequently Asked Questions (FAQ)

Is Upstart a Buy or Sell?

The solution to whether Fintechzoom Upst Stock is a purchase or promote varies primarily based on marketplace conditions, the agency’s current performance, and future increase projections. It’s vital to consider both Wall Street’s outlook and your funding strategy.

What is the Outlook for UPST Stock?

The outlook for UPST stock hinges on numerous elements consisting of market trends, technological advancements, and the company’s strategic initiatives. Analyst sentiments and boom predictions provide treasured insights.

What is the Fair Value of UPST?

Determining the truthful value of UPST requires an evaluation of economic metrics, enterprise comparisons, and future earning potentials. This is often calculated through various fashions through monetary analysts.

What is Upstart Stock Prediction for 2025?

Predictions for Fintechzoom Upst Stock inventory in 2025 depend on its economic health, marketplace position, and the broader fintech landscape’s evolution. While specific forecasts are hard, trend analysis affords a directional view.

What is Upstart and What Does It Do?

Fintechzoom Upst Stock corporation leveraging artificial intelligence to streamline the lending technique, making it extra efficient and on hand for consumers and corporations.

How has Upstart’s Stock Performed Historically?

Historically, Upstart’s stock has skilled both peaks and valleys, reflecting marketplace sentiment, agency overall performance, and broader monetary factors.

What are the Key Technological Advancements Driving Upstart’s Success?

Upstart’s achievement is largely pushed with the aid of its use of AI and gadget studying in credit score selections, enhancing loan approval fees and lowering risks.

How Does Upstart’s Business Model Differ from Traditional Lenders?

Upstart’s business model differentiates through the usage of era to evaluate creditworthiness, taking into account more nuanced and inclusive lending practices as compared to standard credit scoring methods.

What Market Expansion Strategies has Upstart Employed to Grow its Business?

Fintechzoom Upst Stock has targeted on partnerships with banks and credit unions, product diversification, and getting into new financial markets as key techniques for boom.

How Does the Regulatory Environment Impact Upstart and Other Fintech Companies?

The regulatory environment poses both possibilities and demanding situations, impacting licensing, product offerings, and compliance fees for fintech corporations like Upstart.

Who are Upstart’s Main Competitors within the Fintech Lending Space?

Upstart’s major competitors consist of other fintech corporations offering similar lending answers, in addition to traditional financial institutions increasing into virtual lending.

What Partnerships and Collaborations Have Contributed to Upstart’s Growth?

Strategic partnerships with banks, credit score unions, and different fintech platforms were important for Fintechzoom Upst Stock, enabling wider product distribution and technology integration.

What Insights Can Be Gained from Upstart’s Recent Financial Statements and Earnings Reports?

Upstart’s financial statements and income reviews reveal its revenue boom, profitability, operational performance, and insights into its financial health and strategic path.

What Customer Acquisition and Retention Strategies Does Upstart Employ?

Fintechzoom Upst Stock makes a speciality of leveraging technology for a superior purchaser experience, centered marketing efforts, and product innovation to draw and maintain customers.

Who are the Key Members of Upstart’s Leadership Team?

Upstart’s management team contains people with massive enjoy in technology, finance, and commercial enterprise method, guiding the company through boom levels and addressing industry demanding situations.

What is Wall Street’s Outlook on Fintechzoom Upst Stock?

Wall Street’s outlook on Fintechzoom Upst Stock varies, with analysts providing various reviews primarily based at the agency’s overall performance metrics, marketplace position, and destiny ability.

What are the Potential Risks and Challenges Facing Upstart and the Fintech Industry?

Potential dangers consist of regulatory changes, market opposition, technological disruptions, and economic elements affecting patron credit behavior.

What are Upstart’s Future Plans and Growth Projections?

Upstart’s future plans might also involve product and marketplace growth, technological innovations, and strategic partnerships, aiming for sustained growth and marketplace management.

What Should Investors Consider Before Investing in Fintechzoom Upst Stock?

Investors ought to do not forget the fintech industry’s volatility, Upstart’s commercial enterprise model resilience, marketplace opposition, and regulatory environment earlier than making investment selections.

2 thoughts on “2024 Live Fintechzoom Upst Stock & Performance: Key Factors Influencing Its Growth”